About Tulsa Bankruptcy Legal Services

About Tulsa Bankruptcy Legal Services

Blog Article

How Bankruptcy Law Firm Tulsa Ok can Save You Time, Stress, and Money.

Table of ContentsThe Facts About Tulsa Ok Bankruptcy Attorney Revealed5 Easy Facts About Tulsa Bankruptcy Attorney ExplainedTop Tulsa Bankruptcy Lawyers Things To Know Before You BuyThe Of Chapter 7 Bankruptcy Attorney TulsaRumored Buzz on Tulsa Bankruptcy Attorney

The statistics for the other primary kind, Chapter 13, are even worse for pro se filers. (We break down the differences between both types in deepness listed below.) Suffice it to say, consult with a lawyer or 2 near you who's experienced with insolvency law. Below are a couple of resources to locate them: It's reasonable that you may be reluctant to pay for a lawyer when you're already under considerable financial stress.Lots of attorneys likewise use totally free consultations or email Q&A s. Take benefit of that. Ask them if bankruptcy is certainly the ideal selection for your situation and whether they believe you'll qualify.

Advertisement Now that you've determined bankruptcy is without a doubt the ideal course of action and you hopefully cleared it with a lawyer you'll need to obtain begun on the documentation. Prior to you dive right into all the main insolvency types, you must get your own files in order.

An Unbiased View of Top Tulsa Bankruptcy Lawyers

Later on down the line, you'll in fact require to verify that by divulging all types of info regarding your economic events. Right here's a basic list of what you'll need when traveling in advance: Determining records like your motorist's license and Social Safety and security card Tax returns (as much as the previous four years) Evidence of income (pay stubs, W-2s, self-employed incomes, income from properties in addition to any income from government benefits) Bank statements and/or retired life account declarations Evidence of worth of your properties, such as lorry and realty evaluation.

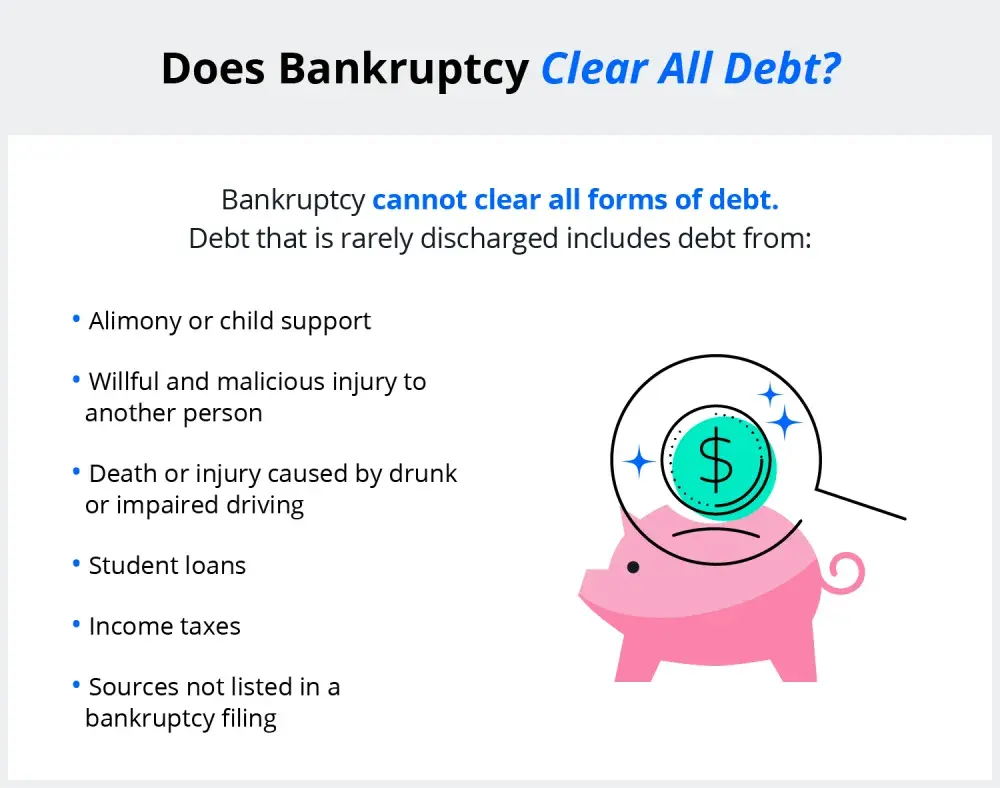

You'll want to recognize what sort of debt you're attempting to settle. Financial obligations like kid support, spousal support and particular tax financial debts can not be discharged (and insolvency can not stop wage garnishment pertaining to those financial debts). Pupil funding financial obligation, on the various other hand, is possible to discharge, but note that it is challenging to do so (Tulsa OK bankruptcy attorney).

You'll want to recognize what sort of debt you're attempting to settle. Financial obligations like kid support, spousal support and particular tax financial debts can not be discharged (and insolvency can not stop wage garnishment pertaining to those financial debts). Pupil funding financial obligation, on the various other hand, is possible to discharge, but note that it is challenging to do so (Tulsa OK bankruptcy attorney).If your earnings is expensive, you have another choice: Chapter 13. This option takes longer to resolve your financial obligations since it requires a long-term repayment strategy typically three to bankruptcy lawyer Tulsa five years prior to a few of your remaining debts are cleaned away. The filing procedure is likewise a whole lot more complex than Chapter 7.

Tulsa Bankruptcy Lawyer for Dummies

A Chapter 7 insolvency remains on your credit report for one decade, whereas a Phase 13 bankruptcy falls off after 7. Both have lasting influence on your credit rating score, and any new debt you get will likely feature greater rates of interest. Prior to you submit your bankruptcy types, you should initially finish a compulsory training course from a credit rating therapy agency that has actually been approved by the Division of Justice (with the notable exception of filers in Alabama or North Carolina).

The course can be finished online, in individual or over the phone. Training courses usually cost in between $15 and $50. You have to finish the program within 180 days of declare insolvency (Tulsa bankruptcy attorney). Utilize the Department of Justice's internet site to locate a program. If you live in Alabama or North Carolina, you should pick and complete a course from a list of separately approved carriers in your state.

The 6-Minute Rule for Tulsa Bankruptcy Legal Services

Check that you're submitting with the appropriate one based on where you live. If your irreversible home has moved within 180 days of loading, you must submit in the district where you lived the better portion of that 180-day duration.

Usually, your bankruptcy attorney will certainly function with the trustee, but you may need to send the person files such as pay stubs, tax obligation returns, and bank account and credit report card statements straight. A common false impression with bankruptcy is that once you file, you can quit paying your debts. While insolvency can help you wipe out many of your unsecured financial obligations, such as overdue medical expenses or personal fundings, you'll desire to maintain paying your monthly settlements for guaranteed financial obligations if you desire to maintain the residential property.

The 5-Second Trick For Tulsa Bankruptcy Lawyer

If you're at risk of foreclosure and have our website actually tired all other financial-relief alternatives, after that submitting for Phase 13 may postpone the foreclosure and conserve your home. Eventually, you will still need the earnings to continue making future home mortgage settlements, along with repaying any late repayments over the training course of your layaway plan.

The audit could postpone any kind of debt relief by several weeks. That you made it this far in the process is a respectable indicator at the very least some of your financial obligations are qualified for discharge.

Report this page